NATIONAL FEDERATION OF POSTAL EMPLOYEES ALL INDIA POSTAL EMPLOYEES UNION Sivasagar Division

Welcome to the Website of NFPE Sivasagar Division

Welcome to the Website of NFPE Sivasagar Division, 3 (Three) Branches under this Division ::: Jorhat Br, Golaghat Br & Sivasagar Br

Divisional Secy: Pranab Borpatra Gohain, PIII ## Moblie 9435093776

Br Secy: Polash Goswami , Golaghat Br PIII ## Moblie - 9435354585

Br Secy: Samad Ullah, Sivasagar Br PIII ## Moblie - 9854279931

Br Secy: Madhu Gohain , Jorhat Br PIII ## Moblie - 9435446992

Tuesday, 22 December 2015

Is attendance compulsory for Central Government employees on the implementation day (01.01.2016) of the 7th CPC recommendations?

Is attendance compulsory for Central Government employees on the implementation day (01.01.2016) of the 7th Pay Commission recommendations?

Central Government employees are wondering if there will be any consequences of taking leave on January 1, 2016, the date of implementation of the 7th Pay Commission report.

The recommendations of the 7th Pay Commission regarding the salaries and perks for the Central Government employees will come into effect from January 1, 2016 onwards. Many are curious to find out the connection between the date of implementation of 7th CPC and reporting to work on the day.

Normally, the date of joining work, date of getting the promotion, date of receiving the increments, transfer date, and retirement dates are very important for a Central Government employee. In the average service period of a Central Government employee, he/she is likely to witness two or three Pay Commissions. Keeping this in mind, it would be better to not absent oneself on January 1, 2016.

“All Central Government employees are advised to report to work on January 1, 2016 (Friday).”

“This is especially so for those who are on long leave. It will help them avoid a lot of problems in future.”

“If 01.01.2016 is announced as a holiday, it will be better to report to work the next day.”

If the recommendations of the 7th Pay Commission are going to be implemented from 01.01.2016 onwards, then the employees will have to come to work that day to accept these recommendations. If he/she is absent on the day, then the day they return to work will be treated as the day they had accepted the new recommendations.

If an employee not to report on the date of implementation of recommendations of new pay commission, this could delay the benefits of the 7th Pay Commission. This could also cause financial losses too due to pay revision as per the recommendations of new pay commission.

According to rules, in order to qualify for the annual increment, an employee has completed 6 months or more in the revised pay structure as per 6th CPC, as on 1st July. A delay of even a single day could deny you an increment, as per the rule.

It is not easy to calculate the date of promotion for Central Government employees. Normally, promotions are granted with retrospective effect. Let us assume that the promotion was given with effect from 01.01.2016. Not reporting to work on that day could cause a number of problems.

Since the government rules are bound to be changed arbitrarily, one can never be sure of the kind of troubles it could cause them. Therefore, it is better to go to work on 01.01.2016.

The recommendations of the 6th Pay Commission were implemented on 01.01.2006, a Sunday. Therefore, the next day was taken as the assumption date. One might remember that the government had issued another order to avoid the confusions that resulted due to this. (Click to view the order)

Even those who are on long leave for any particular reason are advised to report to work on January 1, 2016 at least and then continue with their leave. This will help them avoid a lot of problem

DNS Flushing technique to boost up DOP Finacle/McCamish speed

DNS Flushing technique to boost up DOP Finacle/McCamish speed

What does DNS flushing do?

Whenever you type a URL on the address bar it fetches the corresponding IP address to communicate with web server (it might be any kind of server). When you repeatedly use a same URL its just a waste of network resource to fetch corresponding IP address every time because IP don't change too often.

So your computer stores the combinations of domain name and its IP in local cache to avoid fetching from Domain name System(DNS) every time you use same domain name(URL).

It also holds another crucial info called "Timeout" which says about the valid time for the IP and domain name combination, when this time times out your computer re-fetches the combination from DNS and stores in local cache again.

DNS flushing is the mechanism where the user can manually make all the entries in the cache invalid, so your computer re-fetches new combinations by now on whenever it needs and stores in local

Enough theory, let us do some practical

- First click Windows+R keys in your key board.(Ref the image given below)

Type the following command and press Enter:

ipconfig /flushdns

If the command was successful, you will see the following message:

Now start a new session in Finacle and see the magic.It will be faster than previous session. This technique is useful in afternoon when the Finacle shows sluggish behaviour.

Bonus hike bill passed with effect from April 2014

Arrears of bonus (2014-15) likely !

The Lok Sabha on Tuesday passed a bill allowing doubling of wage ceiling for calculating bonus to Rs 7,000 per month for factory workers with establishments with 20 or more workers, with the benefits being applicable retrospectively from April 2014.

The Payment of Bonus (Amendment) Bill, 2015, was passed by a voice vote, with some members objecting to the raising of eligibility limit for payment of bonus from a salary of Rs 10,000 per month to Rs 21,000.

Government says goodbye to clerk era, changes designation for its staff

By PTI | 22 Dec, 2015, 03.37PM IST

NEW DELHI: Designations like Lower Division Clerk (LDC) and Upper Division Clerk (UDC) in central government's employee hierarchy have been replaced with new nomenclature.

The posts of UDC and LDC under Central Secretariat Clerical Service (CSCS) have been rechristened as Senior Secretariat Assistant and Junior Secretariat Assistant, respectively, an order issued by the Department of Personnel and Training (DoPT) said.

Besides, the post of Assistant under Central Secretariat Service (CSS) has been renamed as Assistant Section Officer, it said.

Both the CSCS and CSS form the backbone of administrative work in the central government.

The total sanctioned strength of CSS and CSCS is 11,467 and 5,933 respectively.

Earlier in March, the DoPT had decided to replace the 'class' categorisation for specifying the seniority of its employees with new alphabetical groupings.

The posts under the central government will be denoted as groups A, B, C and D instead of classes I, II, III and IV in the service rules, it had said.

The Class-III (Group C) employees had expressed concern that they were taunted as 'third-class' employees due to the categorisation.

The Class-I classification is for gazetted officers while Class-II refers to mainly the non-gazetted officers, though there are some gazetted officers in this category too.

Class-III comprises clerical staff and Class-IV (which is now subsumed in Class III or Group C) includes peons and helps or multi-tasking staff in the government hierarchy.

Source : http://economictimes.indiatimes.com/

Tuesday, 15 December 2015

Rules regarding quoting of PAN for specified transactions amended

15-December-2015 19:59 IST

Rules regarding quoting of PAN for specified transactions amended

The Government is committed to curbing the circulation of black money and widening of tax base. To collect information of certain types of transactions from third parties in a non-intrusive manner, the Income-tax Rules require quoting of Permanent Account Number (PAN) where the transactions exceed a specified limit. Persons who do not hold PAN are required to fill a form and furnish any one of the specified documents to establish their identity.

One of the recommendations of the Special Investigation Team (SIT) on Black Money was that quoting of PAN should be made mandatory for all sales and purchases of goods and services where the payment exceeds Rs.1 lakh. Accepting this recommendation, the Finance Minister made an announcement to this effect in his Budget Speech. The Government has since received numerous representations from various quarters regarding the burden of compliance this proposal would entail. Considering the representations, it has been decided that quoting of PAN will be required for transactions of an amount exceeding Rs.2 lakh regardless of the mode of payment.

To bring a balance between burden of compliance on legitimate transactions and the need to capture information relating to transactions of higher value, the Government has also enhanced the monetary limits of certain transactions which require quoting of PAN. The monetary limits have now been raised to Rs. 10 lakh from Rs. 5 lakh for sale or purchase of immovable property, to Rs.50,000 from Rs. 25,000 in the case of hotel or restaurant bills paid at any one time, and to Rs. 1 lakh from Rs. 50,000 for purchase or sale of shares of an unlisted company. In keeping with the Government’s thrust on financial inclusion, opening of a no-frills bank account such as a Jan Dhan Account will not require PAN. Other than that, the requirement of PAN applies to opening of all bank accounts including in co-operative banks.

The changes to the Rules will take effect from 1st January, 2016.

The above changes in the rules are expected to be useful in widening the tax net by non-intrusive methods. They are also expected to help in curbing black money and move towards a cashless economy.

A chart highlighting the key changes to Rule 114B of the Income-tax Act is attached.

Sl.

|

NATURE OF TRANSACTION

|

MANDATORY QUOTING OF PAN (RULE 114B)

| |

Existing requirement

|

New requirement

| ||

1.

|

Immovable property

|

Sale/ purchase valued at Rs.5 lakh or more

|

i. Sale/ purchase exceeding Rs.10 lakh;

ii. Properties valued by Stamp Valuation authority at amount exceeding Rs.10 lakh will also need PAN.

|

2

|

Motor vehicle (other than two wheeler)

|

All sales/purchases

|

No change

|

3.

|

Time deposit

|

Time deposit exceeding Rs.50,000/- with a banking company

|

i. Deposits with Co-op banks, Post Office, Nidhi, NBFC companies will also need PAN;

ii. Deposits aggregating to more than Rs.5 lakh during the year will also need PAN

|

4.

|

Deposit with Post Office Savings Bank

|

Exceeding Rs.50,000/-

|

Discontinued

|

5.

|

Sale or purchase of securities

|

Contract for sale/purchase of a value exceeding Rs.1 lakh

|

No change

|

6.

|

Opening an account (other than time deposit) with a banking company.

|

All new accounts.

|

i. Basic Savings Bank Deposit Account excluded (no PAN requirement for opening these accounts);

ii. Co-operative banks also to comply

|

7.

|

Installation of telephone/ cellphone connections

|

All instances

|

Discontinued

|

8.

|

Hotel/restaurant bill(s)

|

Exceeding Rs.25,000/- at any one time (by any mode of payment)

|

Cash payment exceeding Rs.50,000/-.

|

9.

|

Cash purchase of bank drafts/ pay orders/ banker's cheques

|

Amount aggregating to Rs.50,000/- or more during any one day

|

Exceeding Rs.50,000/- on any one day.

|

10.

|

Cash deposit with banking company

|

Cash aggregating to Rs.50,000/- or more during any one day

|

Cash deposit exceeding Rs.50,000/- in a day.

|

11.

|

Foreign travel

|

Cash payment in connection with foreign travel of an amount exceeding Rs.25,000/- at any one time (including fare, payment to travel agent, purchase of forex)

|

Cash payment in connection with foreign travel or purchase of foreign currency of an amount exceeding Rs.50,000/- at any one time (including fare, payment to travel agent)

|

12.

|

Credit card

|

Application to banking company/ any other company/institution for credit card

|

No change.

Co-operative banks also to comply.

|

13.

|

Mutual fund units

|

Payment of Rs.50,000/- or more for purchase

|

Payment exceeding Rs.50,000/- for purchase.

|

14.

|

Shares of company

|

Payment of Rs.50,000/- or more to a company for acquiring its shares

|

i. Opening a demat account;

ii. Purchase or sale of shares of an unlisted company for an amount exceeding Rs.1 lakh per transaction.

|

15.

|

Debentures/ bonds

|

Payment of Rs.50,000/- or more to a company/ institution for acquiring its debentures/ bonds

|

Payment exceeding Rs.50,000/-.

|

16.

|

RBI bonds

|

Payment of Rs.50,000/-or more to RBI for acquiring its bonds

|

Payment exceeding Rs.50,000/-.

|

17.

|

Life insurance premium

|

Payment of Rs.50,000/- or more in a year as premium to an insurer

|

Payment exceeding Rs.50,000/- in a year.

|

18.

|

Purchase of jewellery/bullion

|

Payment of Rs.5 lakh or more at any one time or against a bill

|

Deleted and merged with next item in this table

|

19.

|

Purchases or sales of goods or services

|

No requirement

|

Purchase/ sale of any goods or services exceeding Rs.2 lakh per transaction.

|

20.

|

Cash cards/ prepaid instruments issued under Payment & Settlement Act

|

No requirement

|

Cash payment aggregating to more than Rs.50,000 in a year.

|

*********

DSM

Friday, 11 December 2015

Thursday, 10 December 2015

All Departmental Exams will be conducted Online forthwith - Directorate clarification

All Departmental Exams will be conducted Online forthwith - Directorate clarification

It was clarified by Postal Directorate that hence forth, the Departmental Examinations will be conducted online and new calendar of Examinations will be issued after the engagement of new agency for conducting the exams online.Copy of the said Postal Directorate letter no A-34012/01/2015-DE dated 04.12.2015 is reproduced below.

CHANGES MADE BY INFOSYS IN DOP MCCAMISH W.E.F 08.12.2015

Infosys has furnished details of functionalities/ fixes deployed in production yesterday (08.12.2015) EOD through email is enclosed below.

It is requested that newly created approver queues should be assigned to the officers concerned only.

Below mentioned Major changes (new functionalities/changes in existing Functionalities) has been moved to production in 08th Dec Deployment.

- Change in Sum assured limits for PLI and RPLI

- Revised Approver Limits for financial transactions due to change in Sum assured limits of PLI & RPLI

- Customer Portal Day End Collection Report ( New Format )

- Changes in Meghdoot Upload/ Bulk Upload for Service Tax Changes

- Proposal Transfer Functionality

- Excess Refund Functionality

- Revised Loan Quote ( Loan Ledger )

- Extension of Withdrawal request for Revival and Surrender till Collection Stage, Disbursement Stage respectively

Expected Activities at User’s end :-

- Access for New Approver queues – Approver 3, Approver 4, Approver 5

- Usage of Meghdoot Upload/Bulk Upload for Service Tax changes

Wednesday, 9 December 2015

NJCA MEETING DECISION INDEFINTE STRIKE FROM 1ST WEEK OF MARCH 2016

NJCA MEETING DECISION

INDEFINTE STRIKE FROM 1ST WEEK OF MARCH 2016

Meeting of the National Joint Council of Action (Railways, Defence and Confederation) was held on 08.12.2015 at JCM National Council Staff Side office, New Delhi. Detailed deliberations on 7th CPC related issues (including Gramin Dak Sewaks and Casual, Contract and daily-rated workers) was held and a Common charter of demands was finalized. It is further decided that the NJCA shall go on indefinite strike from the 1st week of March 2016, if the Government fails to reach a negotiated settlement with the staff side before 1st week of February 2016. A letter intimating this decision will be given to the Government shortly along with the common charter of demands. Letter to Government and charter of demands will be published in the website within two days.

(M. Krishnan)

Secretary General

ConfederationFriday, 4 December 2015

GOVERNMENT WILL CUT RATES ON SMALL SAVINGS CAUTIOUSLY: FM ARUN JAITLEY

Government will cut interest rate on small savings "cautiously" so as to protect vulnerable sections like retired employees, Finance Minister Arun Jaitley said today while expressing confidence that 7th Pay Commission report will not upset the fiscal deficit targets.

He said the government is using more than three-fold increase in cess on petrol and diesel to fund infrastructure projects like highways, but it will be a challenge to fund higher social sector spending due to increased outgo on salary and pension.

Speaking at the Hindustan Times Leadership Summit, he cited the example of the girl child scheme launched last year to saying that "if after one year you immediately slash it (interest rate) down radically, (it) may not be very politically prudent and therefore you have to move in that direction but you have to move a little cautiously".

As a lot of people depend on small savings schemes, the Finance Minister said, "we as an elected government have to look at it in addition to the economic principles with a sense of political pragmatism".

Bankers have passed on as little as 20 per cent of the biggest rate cut effected by RBI since 2009 as they fear becoming uncompetitive to small savings like PPF and Post Office deposits.

Most small saving instruments pay an interest rate of 8.75 per cent, compared to 7.5 per cent on deposits at SBI.

Bank deposit rate has to be lowered if the lending rate is brought down to allow transmission of 1.25 per cent interest rate cut by RBI.

aitley said the impact of the 7th Pay Commission recommendations for higher salary and pension for central government employees, which will result in an additional annual burden of Rs 1.02 lakh crore on exchequer, would last for two to three years.

The recommendations are to be implemented from January 1.

"I am not particularly worried about the fiscal deficit target," he said.

The government, he said, was confident of keeping spending within the the targeted fiscal deficit of 3.9 per cent for the current fiscal year ending March 31, 2016. Besides meeting the target, the quality of fiscal deficit too will be improved, he added.

Source:-The Economic Times

7TH PAY COMMISSION: FRESH HOPE FOR REALTY DEMAND

After witnessing sliding profits over the past three years, the residential real estate market is in desperate need of a stimulus to revive the sector.

While the government’s decision to relax the foreign direct investment norms in real estate last month is expected to play a critical role in addressing the concerns on the supply side, the recommendations of the Seventh Central Pay Commission is being termed a potential game changer on the demand side. The pay panel proposes a hefty salary and pension hike for Central government employees and pensioners.

According to experts, with the real estate market burdened with a large volume unsold inventory, just removing the supply-side bottlenecks won’t help as the lack of demand will keep the markets under pressure. However, the demand might witness a surge as a higher disposable income in the hands of a substantial chunk of the population might just motivate investment in residential property.

A report prepared by Neelkanth Mishra, Prateek Singh and Ravi Shankar of Credit Suisse says that the Pay Commission recommendations will have a significant impact on the real estate cycle in small towns as more than 80 per cent of Central government employees reside in tier II, III cities.

The Pay Commission boost

The report analysing the impact of the recommendations point out that as state governments and Central PSUs follow through the CPC (recommended hike of 23.6 per cent) proposals, almost 3.4 crore individuals (employees and pensioners) will witness increase in their incomes. The housing and transportation sectors will be the biggest beneficiaries of the rise in income and spending capacity of government employees.

“Altogether around 80 per cent of the beneficiaries would see an increase of less than Rs10,000 per month and account for 50 per cent of the payout. The rest would get around Rs 24,000 more every month on an average,” said the report.

“Altogether around 80 per cent of the beneficiaries would see an increase of less than Rs10,000 per month and account for 50 per cent of the payout. The rest would get around Rs 24,000 more every month on an average,” said the report.

According to Credit Suisse, out of the total state and central employees, the 6O lakh, who will see around Rs 24,000 salary increase per month, are likely to be instrumental in lifting the housing sector demand.

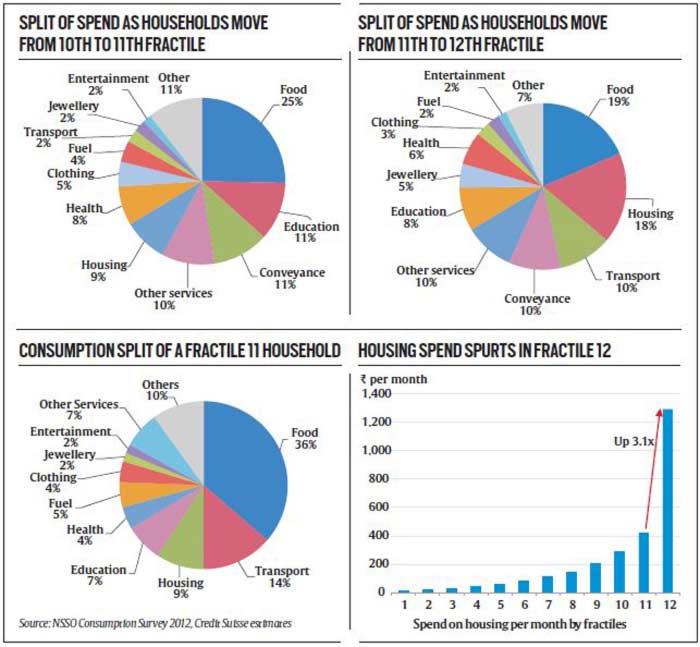

The National Sample Survey Organisation (NSSO) classifies the country’s population into 12 classes (fractiles) demarcated by monthly per capita income.

The report states that while spending on food and transportation goes up the most when disposable incomes rise for those between the 10th and 11th fractiles, it also pointed to the fact that as households move from the 11th to the 12th fractile (8.3 per cent of households), the spend on rent rises 3.1 times and there is a similar impact on home ownership too.

“Most of this impact is likely in the smaller cities (only 20 per cent of central government employment is in the tier I cities). The Pay Commission recommendation, in our view, is an important milestone in the real-estate cycle in the smaller towns, recent weakness was likely the effect of the last pay commission fading,” said the Credit Suisse report.

While the Centre may take six months in implementing the recommendations, a 3-5 per cent higher increase than recommended would take the hike in the comprehensive wage bill to Rs 4.5-4.8 lakh crore which is expected to be spread over a period of two years starting from June 2016 as states and Central PSUs take their decisions. “We estimate 75 per cent of the increase should occur in FY17, and the rest in FY18,” said the report.

While the report says that impact on housing and real estate will be substantial and lift demand, there are some who feel that the benefits may not be huge.

“I think the Pay Commission recommendations will also be inflationary so the actual benefit that may come to employees may only be around 10 per cent as against a hike of 23.5 per cent. And if the developers decide to increase the price then it would be a dampener,” said Samantak Das, chief economist & national director, Knight Frank India.

The supply side effect

While the government had, in 2005, eased the foreign direct investment norms for real estate sector and allowed 100 per cent FDI in townships, housing and built-up infrastructure and construction developments, it had imposed certain conditions.

However, with ambitious targets like ‘Housing for All’ and Smart Cities in the pipeline, what the government needs is a thriving real estate market and thus, in November, the Centre decided to do away with some of the restrictive conditions.

While the earlier policy required a minimum of 20,000 square meters of development and a minimum capital of $5 million, the government has now removed those conditions and it is expected that these will result into higher investment flow into city-centric developments where the condition of 20,000 square metres was a dampener.

Along with this, the need to bring in investment within six months of commencement of the project has also been removed.

Das, however, said that FDI will not flow in till the time demand for residential housing picks up as investors will only come if the market is good.

“While the office market has picked up, residential market is expected to take at least 12 more months to pick up. The market is still full of unsold inventory and till the time it gets absorbed, the sector will remain weak,” said Das.

Subscribe to:

Comments (Atom)